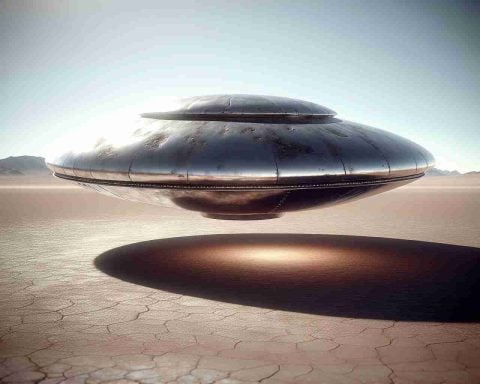

- Tuttle Capital is launching the first-ever ETF focused on companies involved in ‘reverse-engineered alien technology’, named UFOD.

- The ETF plans to allocate at least 80% of its assets to aerospace and defense firms linked to extraterrestrial innovations.

- CEO Matthew Tuttle emphasizes the potential for profit driven by increasing governmental disclosures on UFOs.

- The investment carries high risk due to limited information on advanced alien technology, making it speculative.

- AI plays a crucial role in investment decision-making, as Tuttle employs it for 90% of his analysis.

- Investors are advised to approach this unique opportunity with caution amid its high reward potential.

Are you ready to take your investments to cosmic heights? Tuttle Capital is launching a groundbreaking ETF that aims to tap into the mysterious realm of “reverse-engineered alien technology”! Dubbed the Tuttle Capital UFO Disclosure AI Powered ETF (ticker: UFOD), this ambitious fund will funnel at least 80% of its assets into companies believed to be at the forefront of extraterrestrial innovations.

Imagine investing in aerospace giants and defense contractors rumored to be working with classified technology that could revolutionize our understanding of the universe. Matthew Tuttle, CEO of Tuttle Capital, has long been captivated by UFOs and sees significant potential for profit as governmental disclosures about unidentified flying objects become more frequent.

But hold on! This investment opportunity isn’t without its risks. Tuttle warns that the foundational information regarding advanced alien tech remains elusive, making UFOD a speculative venture. Without sufficient revelations from the government, the ETF’s launch may falter.

As exciting as “alien-level” advancements sound, Tuttle isn’t just banking on mystery—he’s leveraging AI as a powerful tool in investment selection, using it for 90% of his analysis. While the prospect of UFO technology might feel out of reach for most investors, AI is a tangible force reshaping the financial landscape.

So, will you be among the intrepid investors looking towards the stars? The key takeaway is clear: investing in the unknown can yield high rewards, but proceed with caution in this intergalactic venture!

Is Investing in Alien Technology the Future? Discover the Truth Behind UFOD!

Overview of the Tuttle Capital UFO Disclosure ETF (UFOD)

The Tuttle Capital UFO Disclosure AI Powered ETF, ticker UFOD, is set to invest in companies engaged in or rumored to be associated with advanced technology potentially sourced from extraterrestrial origins. The ETF aims to allocate at least 80% of its assets to these companies, connecting investors with sectors that might be on the cutting edge of technology, fueled by government disclosures around UFO phenomena.

Key Features of the Tuttle Capital UFO ETF

– Innovative Focus: The ETF is centered around aerospace companies and defense contractors, promising exposure to exciting sectors.

– AI-Driven Analysis: Matthew Tuttle incorporates AI analytics for 90% of the fund’s investment decisions, ensuring that selections are based on sophisticated technological frameworks.

– Speculative Nature: Due to the opaque nature of alien technology and limited regulatory disclosures, investing in the UFOD ETF carries inherent risks.

Considering the Potential: Pros and Cons

# Pros:

1. Unique Market Niche: Tapping into a rarely explored investment category.

2. Growth Potential: If the speculated technologies come to fruition, the financial returns could be substantial.

3. AI Utilization: Combines cutting-edge technology with investment strategies, potentially enhancing decision-making processes.

# Cons:

1. High Risk: Heavy reliance on speculative technology that lacks verifiable data.

2. Market Volatility: Investments tied to uncertain government disclosures and potential market reaction.

3. Limited Transparency: The fund’s reliance on non-verified sources for its investments may deter traditional investors.

Market Trends and Predictions

With the increasing public interest in UFOs and unclassified military reports, there’s a burgeoning market potential for technology associated with these phenomena. Analyst predictions suggest that if significant technological advancements are confirmed, sectors supported by the UFOD ETF could thrive. However, close monitoring of federal disclosure patterns and technological developments will be crucial.

Frequently Asked Questions (FAQs)

1. What types of companies will UFOD invest in?

– UFOD will primarily invest in aerospace and defense companies, alongside those involved in research linked to potential alien technology.

2. How does the ETF handle potential risks?

– Tuttle Capital employs advanced AI tools to help mitigate risks by analyzing data and predicting trends, but the speculative nature remains a significant risk factor.

3. When is the anticipated launch date for the ETF?

– The exact launch date is not specified, but it is expected to coincide with increasing disclosure from governmental entities regarding UFOs.

Related Links

For more detailed insights and updates on this groundbreaking ETF and others, visit Tuttle Capital.

In summary, while the prospect of investing in potential alien technology through UFOD may sound like science fiction, it brings real investment implications that should be approached cautiously. The blending of AI with speculative ventures raises both excitement and apprehension, putting investors at a crossroads of innovation and uncertainty.