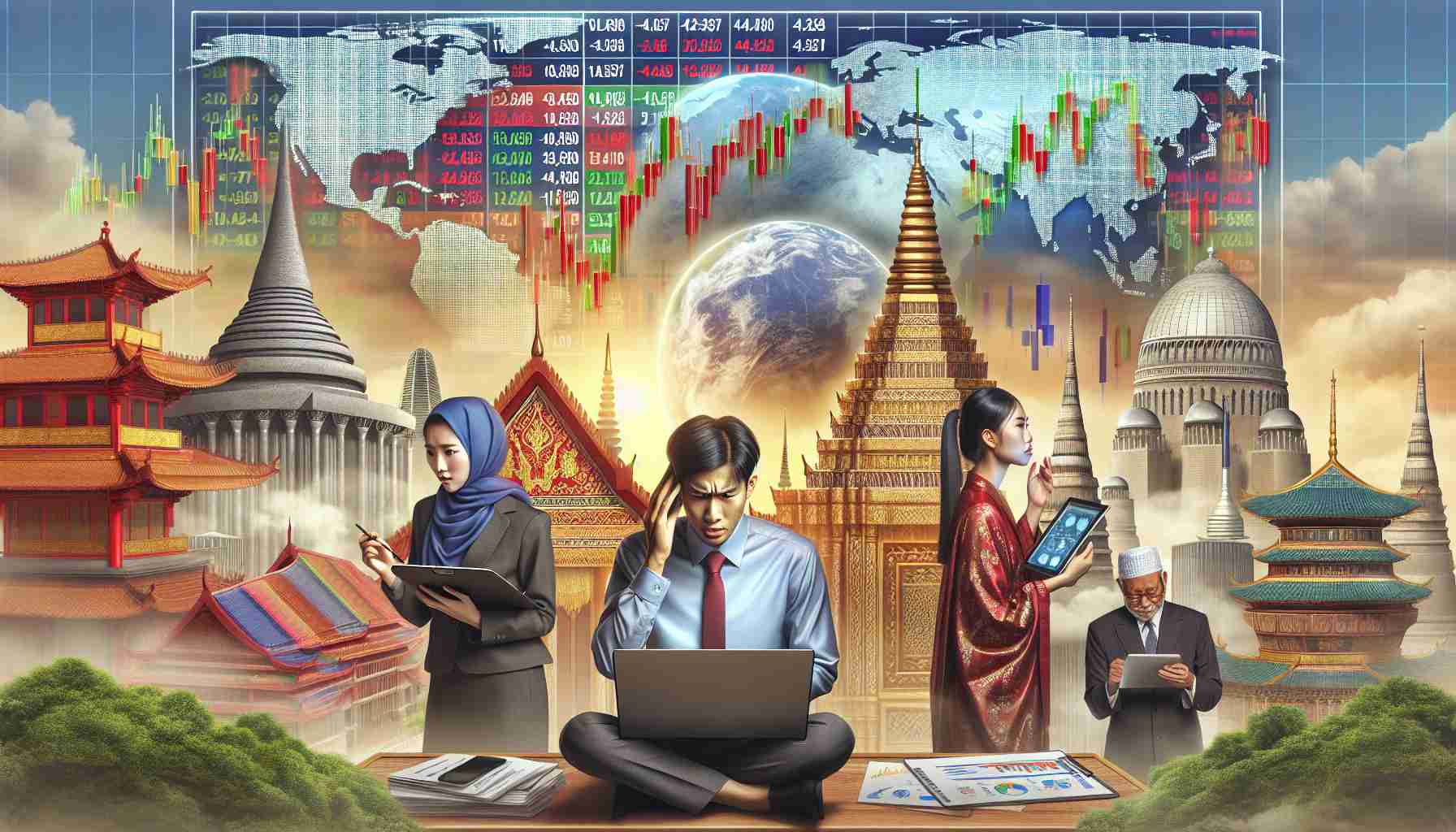

Global markets have seen varying shifts following recent economic developments. In Asia, the Shanghai Composite and Shenzhen’s A-share index experienced gains, while Hang Seng in Hong Kong faced a slight decline. The rise in Chinese markets can be attributed to adjustments in Loan Prime Rates, providing relief to borrowers, especially within the property sector post a borrowing clampdown.

Meanwhile, Tokyo’s Nikkei 225 and Seoul’s Kospi reflected positive momentum, with Australia’s S&P/ASX 200 also making gains. Oil prices, after a recent dip, showed signs of recovery amidst concerns over potential disruptions in Iranian exports. Brent crude saw a modest increase to $73.37 per barrel, hinting at market stabilization.

On Wall Street, indices continued their upward trajectory, setting new records. The S&P 500 and Nasdaq closed at all-time highs, reflecting sustained positive sentiment among investors. The Dow Jones Industrial Average also reached a new peak. This consistent growth marks a notable trend in market performance.

Overall, global markets remain responsive to a complex interplay of factors, from geopolitical tensions to economic policies. The resilience displayed by various indices indicates a degree of confidence in the current market landscape.Observers will be keenly watching these ongoing shifts, which offer insights into the evolving dynamics of the world economy.

Asian Markets Navigate Global Economic Changes with Strategic Resilience

As Asian markets respond dynamically to global economic changes, a myriad of factors influence their trajectories. What key aspects are shaping the Asian markets’ reactions to global economic shifts? The following facts shed light on some lesser-known dimensions of this intricate scenario.

1. Belt and Road Initiative Impact: China’s ambitious Belt and Road Initiative (BRI) plays a significant role in reshaping economic landscapes across Asia. The strategic investments and infrastructure developments under the BRI have ripple effects on regional market dynamics, influencing trade patterns and investment flows.

2. Technology Sector Fortification: Asia’s growing dominance in the technology sector, specifically in areas such as semiconductor manufacturing and digital innovation, underscores the region’s resilience amidst global economic uncertainties. Companies driving technological advancements in Asia contribute substantially to the region’s economic stability.

3. Currency Fluctuations and Trade Relations: The interplay of currency fluctuations and evolving trade relations within Asia and with global partners can significantly impact market performance. Monitoring exchange rate movements and trade policies is crucial to understanding how Asian markets respond to broader economic changes.

4. Sustainable Investing Trends: Increasing focus on sustainable investing and environmental, social, and governance (ESG) factors is shaping investment decisions in Asian markets. Investors are increasingly prioritizing companies with strong ESG practices, influencing market valuations and capital flows.

5. Regulatory Reforms and Policy Adjustments: Ongoing regulatory reforms and policy adjustments in various Asian economies, such as tax changes, industry regulations, and fiscal stimulus measures, introduce complexities that require market participants to adapt swiftly to changing business environments.

What are the key challenges and controversies associated with the Asian markets’ reactions to global economic changes? Addressing these aspects is vital for a comprehensive understanding of the advantages and disadvantages that characterize this dynamic landscape.

Challenges: Volatility stemming from global economic uncertainties, trade tensions impacting export-reliant economies, regulatory compliance complexities, and the need to balance growth with sustainability pose challenges for Asian markets in navigating rapid shifts in the global economic terrain.

Controversies: Debates surrounding market manipulation, transparency issues in financial reporting, geopolitical tensions affecting market sentiment, and concerns over the long-term sustainability of economic growth models in certain Asian economies spark controversies that influence market behavior.

In conclusion, the adaptability and resilience demonstrated by Asian markets amid global economic changes highlight their strategic positioning and capacity to weather diverse challenges. Understanding the nuanced dynamics at play in these markets is essential for investors, policymakers, and market observers seeking to grasp the full spectrum of opportunities and risks within this vibrant economic landscape. Stay tuned for further insights into the evolving Asian market scenarios.

Explore more economic insights at Economics Times.